Results at a glance

- New Zealand farmer confidence fell in the third quarter, and farmers are now evenly split on the prospects for the agri economy in the year ahead.

- Government policy and rising input costs were the key factors cited by farmers holding a pessimistic outlook for the rural economy while rising commodity prices was the key reason nominated by farmers with a positive outlook

- Farmers’ expectations of their own farm business performance were marginally down on last quarter, but remain at net positive levels overall

- Dairy farmers are now significantly less positive about the prospects for their own businesses while sheep and beef farmers and growers are marginally more positive.

- Investment intentions were marginally higher this quarter with sheep and beef farmers recording the strongest appetite for investment

Rabobank New Zealand CEO Todd Charteris

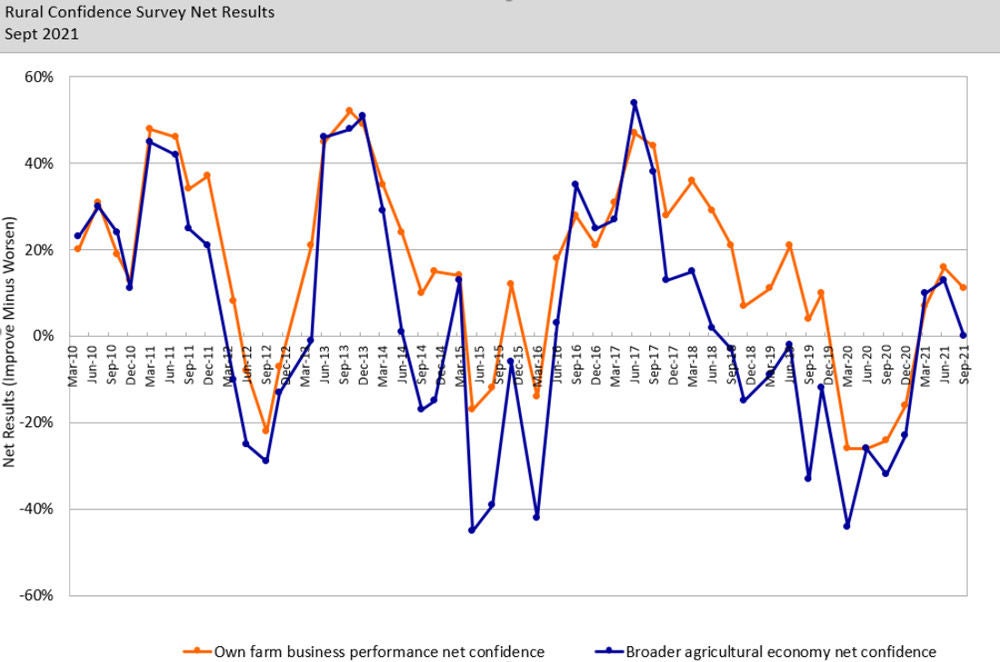

Having climbed into net positive territory following consecutive lifts across the last three quarters, New Zealand farmer confidence has reversed course and there is now an even split of farmers expecting the agricultural economy performance to improve and those expecting it to worsen, the latest Rabobank Rural Confidence Survey has found.

The survey – completed earlier this month – found net farmer confidence across the nation fell to a net reading of zero, down from +13 per cent last quarter. The number of farmers expecting the rural economy to improve in the next 12 months was down to 23 per cent (from 32 per cent previously), while the number expecting the rural economy to deteriorate rose to 23 per cent (up from 19 per cent). A total of 52 per cent were expecting similar conditions (up from 47 per cent).

Rabobank New Zealand CEO Todd Charteris said while there were plenty of strong factors supporting farmer optimism, a host of concerns were also gnawing away at farmer confidence.

“While demand for New Zealand’s key agricultural commodities remains strong, and commodity prices are holding up well, lingering farmer anxiety over government policy remains a key source of farmer concern with close to three-quarters of farmers expecting conditions to worsen citing this as a reason for their pessimistic outlook,” he said.

The survey also found rising input costs were a key source of farmer apprehension with this cited by more than a third of pessimistic farmers — the highest level recorded in the survey at any stage across the last decade.

“Whether it’s the recent spike in fertiliser costs, the on-going impact of labour shortages, or general supply chain challenges, it’s clear that farmers are now feeling significantly more input cost pressure than they have over recent seasons,” Mr Charteris said.

“In addition, farmers identified overseas markets and global shipping disruptions as key sources of concern.”

Mr Charteris said all sector groups were more now pessimistic about the prospects for the agri economy, with dairy farmers recording the biggest fall.

“While the forecast farmgate milk price for the 2021/22 season remains healthy, dairy farmers have had plenty to contend with over recent months including largely unfavourable weather conditions, challenges sourcing labour and time-consuming consultation meetings on a raft of environmental regulations.”

“On top of this, we’ve seen a general downward pricing trend in GDT auctions since our last survey in June, and all these factors have combined together to drive dairy farmer sentiment lower.”

“As a result, only one-in-five dairy producers is now expecting the performance of the agricultural economy to improve in the next 12 months, well back on the 35 per cent expecting improved conditions last quarter.”

Farm business performance

The survey found farmers’ expectations for their own farm business performance in the year ahead was marginally lower than in the last quarter. Less farmers are now expecting their own farm business to perform better (28 per cent from 32 per cent previously) while more are expecting farm business performance to deteriorate (28 per cent from 32 previously) and this resulted in the net reading falling to +11 per cent from +16 percent previously.

As with the broader agri confidence reading, the survey found dairy farmers were significantly less optimistic about the prospects for their own operations. In contrast, sheep and beef farmers and growers were feeling marginally more positive.

“While sheep and beef farmers hold many of the same concerns as their counterparts in the dairy industry, they’ve been by buoyed by record pricing for beef and lamb products of late.” Mr Charteris said.

“And with strong pricing forecast to hold over coming months, we’ve seen a slight up-tick in the number of sheep and beef farmers expecting the performance of their business to improve over the next 12 months.”

Having fallen into net negative territory on this measure in recent quarters, the survey found confidence among horticulturalists was now back in positive territory, with more growers expecting conditions to improve over the next 12 months than those expecting conditions to worsen.

“Ongoing strong demand from overseas markets is likely to have played a key role in the small lift in growers’ expectations, while sector participants will also have taken confidence from the recent government announcement that vaccinated seasonal workers will be able to travel to New Zealand from the pacific without having to go through managed isolation from October,” Mr Charteris said.

Investment intentions

Farmers’ investment intentions rose marginally from the previous survey. A total of 25 per cent were expecting to increase farm investment in the coming 12 months (24 per cent previously), with 11 per cent intending to decrease investment (from 13 per cent) and the remainder expecting to invest the same.

“While dairy farmers investment intentions have reduced, investment intentions remain at net positive levels across all sectors,” Mr Charteris said.

“Sheep and beef farmers recorded a notable jump in investment intentions — with 30 per cent of sheep and beef farmers now looking to invest more and only nine per cent looking to decrease investment — and they now have the strongest investment intentions of all farmer groups.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

Rabobank New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of about 10 million clients worldwide through a network of close to 1000 offices and branches. Rabobank New Zealand is one of the country's leading agricultural lenders and a significant provider of business and corporate banking and financial services to the New Zealand food and agribusiness sector. The bank has 32 offices throughout New Zealand.

Media contacts:

David Johnston

Media Relations Manager

Rabobank New Zealand

Phone: 04 819 2711 or 027 477 8153

Email: david.johnston@rabobank.com

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: +612 8115 2744 or +61 2 439 603 525

Email: denise.shaw@rabobank.com