Results at a Glance

- New Zealand farmer confidence remains relatively unchanged from last quarter with an even split of farmers expecting the performance of agricultural economy to improve and those expecting it to worsen.

- Despite the unchanged overall reading, there were significant shifts in farmer sentiment within the key sector groups, with dairy farmers now significantly more positive about the agri economy and dry stock farmers and horticulturalists significantly more pessimistic.

- Rising commodity prices were the key factor cited by farmers with an optimistic outlook for the agri economy, while government policy, rising input costs and labour shortages were the key concerns among farmers with a negative outlook.

- Farmers’ confidence in their own farm business performance was slightly down, led by a significant drop in confidence among growers.

- Investment intentions across the sector were marginally higher with sheep and beef farmers maintaining the strongest investment intent.

New Zealand farmer confidence continues to ‘hang in the balance’ as 2021 concludes, with an even split of farmers expecting the performance of the agricultural economy to improve in the year ahead and those expecting it to worsen.

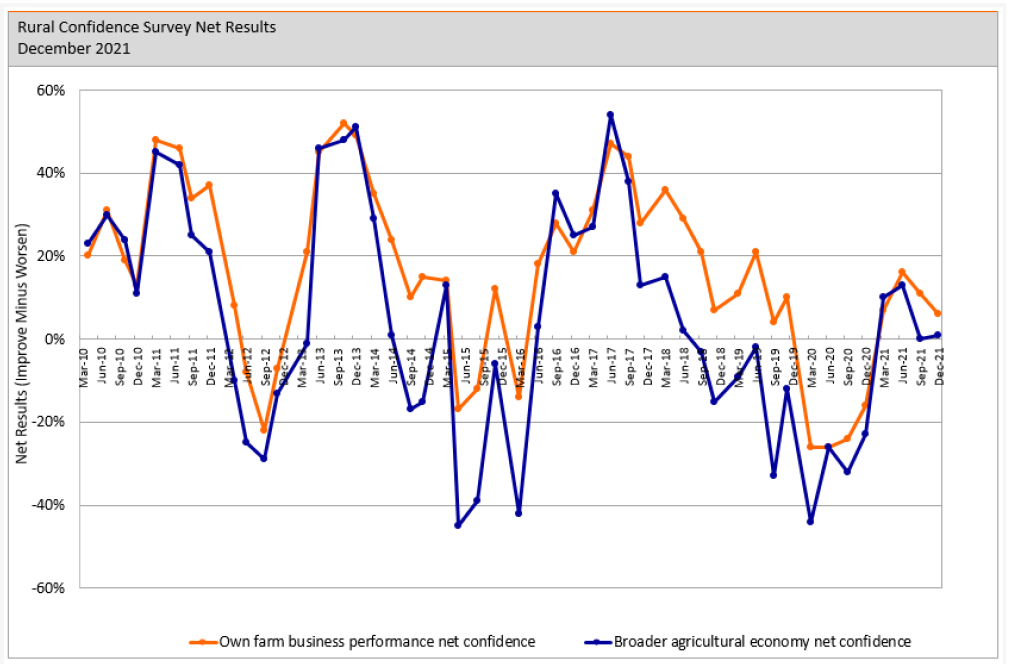

The fourth and final Rabobank Rural Confidence Survey of the year — completed late last month — found net farmer confidence relatively unchanged from last quarter, inching fractionally higher to + one per cent, up from the net zero reading recorded in September.

Rabobank New Zealand CEO Todd Charteris

Rural Confidence Survey Results - December 2021

The survey found the number of farmers expecting conditions in the agricultural economy to improve in the coming 12 months had risen to 28 per cent (up from 23 per cent last quarter) while there were also more farmers expecting conditions to worsen (27 per cent from 23 per cent previously). The number of farmers expecting the performance of the agricultural economy to stay the same fell to 43 per cent (from 52 per cent previously).

Rabobank New Zealand CEO Todd Charteris said the lack of movement in the overall confidence reading masked sizeable swings in sentiment within New Zealand’s key sector groupings.

“In this survey we’ve seen dairy farmer confidence about the broader agri economy rebound strongly after a drop in quarter three, however, this has been offset by reduced confidence among both sheep and beef farmers and horticulturalists,” he said.

The survey found dairy farmer confidence in the economy was up to a net reading of +12 per cent (- three per cent previously) while sheep and beef farmers fell to a net reading of

- 1 per cent (+ seven percent last quarter) and growers to – 10 per cent (+ two per cent previously).

“Dairy farmer confidence has lifted off the back of the upward pricing trend at recent Global Dairy Trade (GDT) events which has seen global dairy commodity prices reach levels not seen 2014,” Mr Charteris said.

“The recent lift in the Fonterra milk price forecast came outside the survey period — and is therefore not reflected in the results — however this will only have further buoyed sentiment among dairy farmers who are now looking at a record high milk price for the current season.”

While pricing for New Zealand’s red meat and horticulture products remains robust, Mr Charteris said confidence among sheep and beef farmers and growers was being dragged lower due to a range of farmer concerns.

“The lower sentiment among sheep and beef farmers is being driven by concerns over government policy — with this cited by 85 per cent of dry stock farmers with a negative outlook — while horticulturalists are now less positive due to a host of issues including rising input costs, labour shortages and supply chain disruption.”

Own farm business performance

The survey found farmers’ confidence in their own farm business performance was marginally down with 28 per cent of farmers now expecting the performance of their own farm business to improve (unchanged), 22 per cent expecting business conditions to worsen (17 per cent previously) and 49 per cent expecting conditions to stay the same (down from 54 per cent).

In line with the survey results for the broader agri economy, dairy farmers were significantly more confident about the prospects for their own farm performance over the next 12 months, while dry stock farmers and growers were less positive.

“Dairy farmers are now the most positive on this measure of all the sector groups with more than one-third expecting their own farm business performance to improve in the year ahead, and only one in ten now expecting it to worsen,” Mr Charteris said.

“On the flip side, sheep and beef farmer confidence in their own operations drifted lower, however they remain at net positive levels on this measure overall. Grower confidence fell more markedly and, with the net reading on this measure slumping to - 30 per cent, growers’ confidence in the performance of their own businesses is now at the lowest level recorded at any stage over the last decade.”

Labour challenges

Mr Charteris said the latest survey included additional questions related to labour shortages and the level of impact these were having on farmers businesses.

“We last asked these questions in quarter two and the results from our most recent survey confirm labour shortages continue to be key challenge for the sector as they were six months ago,” Mr Charteris said.

“Forty percent of farmers said they have been affected by labour shortages or expect they will be in the coming year and, of these, more than a third said they expected the impact on their business to be significant.”

The survey found horticulturalist were the most severely impacted by this issue with close to two-thirds saying labour shortages had already affected their business or were expected to over coming months.

Farm Investment

The survey found farm business investment intentions were marginally higher than in the last quarter with 27 per cent of farmers now planning to increase investment over the next year and only nine per cent expecting investment to decrease.

“Sheep and beef farmers continue to hold the strongest investment intentions of all sector groups with close to a third looking to increase investment in the year ahead,” Mr Charteris said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency TNS, interviewing a panel of approximately 450 farmers each quarter.

Rabobank New Zealand is a part of the global Rabobank Group, the world’s leading specialist in food and agribusiness banking. Rabobank has more than 120 years’ experience providing customised banking and finance solutions to businesses involved in all aspects of food and agribusiness. Rabobank is structured as a cooperative and operates in 40 countries, servicing the needs of about 10 million clients worldwide through a network of close to 1000 offices and branches. Rabobank New Zealand is one of the country's leading agricultural lenders and a significant provider of business and corporate banking and financial services to the New Zealand food and agribusiness sector. The bank has 32 offices throughout New Zealand.

Media contacts:

David Johnston

Media Relations Manager

Rabobank New Zealand

Phone: 04 819 2711 or 027 477 8153

Email: david.johnston@rabobank.com

Denise Shaw

Head of Media Relations

Rabobank Australia & New Zealand

Phone: +612 8115 2744 or +61 2 439 603 525

Email: denise.shaw@rabobank.com