In response to the European Union’s decision to hike tariffs on Chinese electric vehicles, China has initiated an investigation into the dairy subsidies provided by the EU and several of its member states.

This investigation, focusing on the EU’s Common Agricultural Policy and national plans of eight countries, could reshape the global dairy trade landscape with increased trade tensions potentially benefitting dairy exporters from Australia, New Zealand, the UK, and the US, according to a new report by Rabobank.

However, the report notes, market impacts are unlikely to be felt until at least 2026– if at all.

Increased tariffs on Chinese electric vehicles triggered this probe.

The report, titled Navigating trade tension: Potential impacts of China’s probe into EU dairy subsidies, says the EU’s recent announcement that it will increase tariffs on Chinese electric vehicles has led to a counterreaction.

Rabobank senior agricultural analyst, Emma Higgins

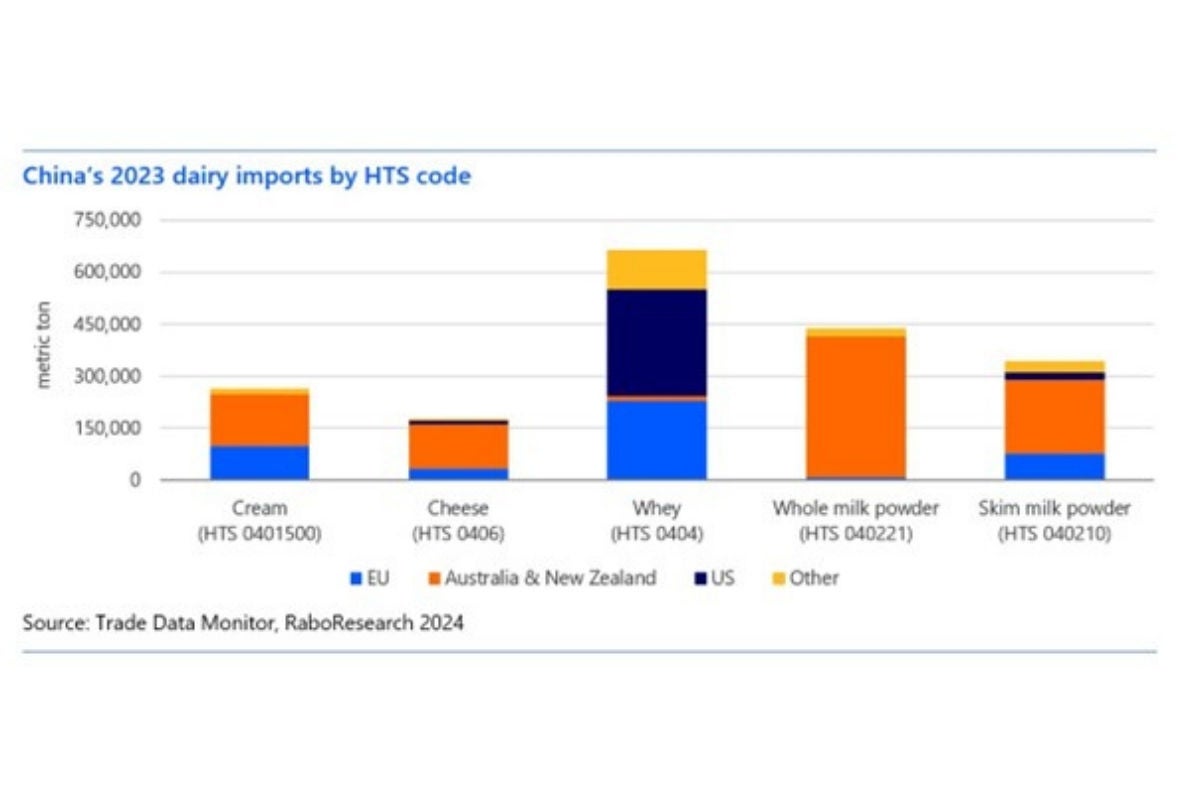

“With the EU tariffs set to rise significantly, China’s Ministry of Commerce has launched an investigation into EU dairy subsidies that could have far-reaching consequences for European exports. The targeted products, including liquid cream and various cheeses, represent a significant trade value of USD 572.5 million as of 2023,” report co-author senior agricultural analyst Emma Higgins said.

The scope of the investigation is limited but could expand

While the report says the current investigation does not encompass the highestvolume categories such as whey-derived products and milk powders, there is concern within the industry that China may broaden its investigation.

“The investigation, expected to run through most of 2025, leaves the door open for potential market impacts by 2026. France, as a major exporter, could be significantly affected, given its 37 per cent share in the targeted product exports,” Ms Higgins said.

“Meanwhile, some dairy industry participants are concerned that China could expand the scope of investigation-targeted products.”

Non-EU countries to potentially benefit from trade shifts

“As the investigation unfolds, non-EU dairy exporters like Australia, New Zealand, the UK, and the US are poised to capitalise on any resulting trade shifts,” Ms Higgins said.

“Should we see any additional tariffs implemented, products sourced from this part of the world (Oceania) could be more competitively priced.

“As it stands, New Zealand and Australia already export large volumes of cheese and cream into China and would therefore be well-placed to step in and fill any trade gaps that might arise.”

China’s dairy industry is at a crossroads

The report says China’s domestic dairy industry is currently experiencing overproduction relative to demand.

“This has prompted a strategic shift toward value-added dairy products to better utilise the surplus and potentially reduce reliance on imports. The ongoing trade tensions with the EU may inadvertently accelerate this transition, offering a silver lining for local Chinese dairy producers and exporters from other nations.” Ms Higgins said.

RaboResearch Disclaimer: Please refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.