Recent structural and cyclical changes are ushering in a new era of animal protein consumption in China, according to a new report from food and agribusiness banking specialist Rabobank. And companies throughout the global animal proteins supply chain will need to adjust their strategies to meet the sophisticated demands of modern Chinese consumers.

In the recently-released report, New consumption trends in China offer opportunities for animal protein, Rabobank says consumption trends are evolving in China’s animal protein market due to cyclical factors such as market oversupply and economic slowdown, and structural factors such as demographic shifts and changing consumer values.

“Across recent decades, China’s animal proteins market has seen plenty of change due to rapid economic growth, the opening of its markets, and digitisation trends triggering the fast evolution of the country’s consumer market,” report author, RaboResearch senior animal protein analyst Chenjun Pan said.

“These developments saw Chinese consumers double their consumption of meat in less than 30 years, from 35 kilograms per capita in the mid-1990s to 72 kilograms in 2023, demonstrating a growth story that has attracted a lot of investment.”

However, the report says, in recent years China’s economy has changed gears, with GDP growth slowing significantly.

Chenjun Pan, RaboResearch, Senior Animal Protein Analyst

“In parallel, middle-class wealth has increased substantially, supporting a resilient spending power, albeit with income growth slowing. We’ve also seen the Chinese animal protein market oversupplied across the last year, resulting in sluggish prices and a supply chain that is struggling to manage supply.” Ms Pan said.

Despite these changes, Ms Pan said, in general, China’s animal protein consumption remains resilient.

“Statistics show that consumers have lowered spending in other categories but maintained spending on food. Taking a deeper look however, we observe that China’s animal protein consumption is developing new patterns,” she said.

“The days of one-size-fits-all products in China’s animal protein market are over. Today’s consumers expect more than just a product, they seek a comprehensive value proposition that includes good service and valued experiences.”

Demographic changes reshaping preferences

The report says China’s total population reached an inflection point in 2021, with reductions following in 2022 and 2023, and the birth rate declining since 2017.

“Forecasts indicate that the population will decline from the current 1.4 billion to 1.3 billion by 2050, and experts estimate that the population aged 65 and above may exceed 20%,” the report says.

Ms Pan said China’s aging population and smaller household sizes are leading to a nuanced impact on animal protein consumption.

“The market is gradually moving away from pork, traditionally the dominant choice, toward poultry, beef and seafood, which are favoured for their perceived health benefits,” Ms Pan says.

“Additionally, the older generation’s adoption of e-commerce, food delivery and convenience foods mark the end of past consumption behaviours.”

Four key trends influencing future

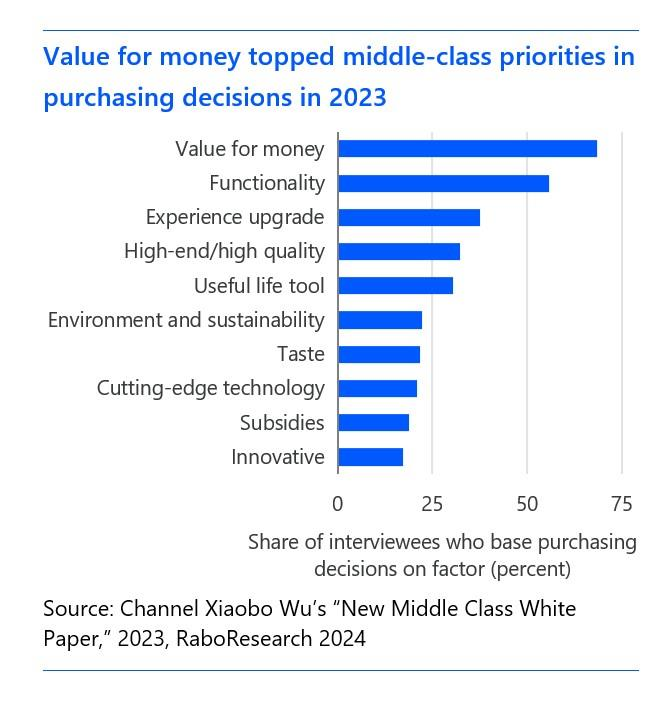

Among all the changes, the report says, four major trends stand out in shaping future animal protein consumption in China: value for money, the ‘experience economy’, a focus on nutrition and health, and a changing channel mix for purchases.

“Consumption of beef and seafood has increased strongly over the last decade despite slower income growth, illustrating that consumers continue to seek higher value but at reasonable prices,” Ms Pan said.

“This trend is supported by the recent ‘New middle Class White Paper’ survey which found ‘value for money’ was the top consideration in purchasing decisions.

“In our view, consumers’ perception of value includes not only the product value, but also services, such as convenience and time saved. Ready-to-eat/cook products are fast growing product categories, as they enable consumers to shorten the time spent preparing food and making home cooking more convenient.”

Ms Pan said the second identified trend, the ‘experience economy’, relates to a growing preference for spending on services over goods, reflecting a desire for valued experiences.

“Expenditure on services has grown faster than overall expenditure on goods and increased its share from 39.7% in 2013 to 45.2% in 2023. However, this is still lower than spending on experiences in more developed economies, where around 70 to 75% of consumer expenditure is on services,” she said.

“China’s total foodservice sales have delivered a steady recovery upon reopening post-pandemic with sales up by 8.4% year-on-year for the first five months of 2024, and we expect consumers’ expenditure on services will also rise in the coming years.”

The report says the third trend, a focus on health and nutrition, is increasingly influencing purchasing decisions in China.

“With consumers increasingly aware of health and nutrition post-pandemic, their perceptions of various proteins have evolved, and these changing perceptions are influencing the market acceptance of each protein,” Ms Pan said.

“Pork remains the staple for Chinese consumers, but its share is down from 85% in the 1990s to 58% in 2023, with poultry and beef gaining share. An aging population might further reinforce this trend as older people turn to proteins perceived as lower in fat, more digestible, and higher in nutrition, like poultry and seafood.”

The final trend, Ms Pan said, was the changing channel mix for purchases.

“Distribution channels have experienced great changes in recent decades, with the rapid growth of e-commerce, the restructuring of traditional wet markets, the ups and downs of supermarkets and hypermarkets, and the emergence of convenience stores,” Ms Pan said.

“The latest emerging distribution channel we are seeing is live streaming. For example, Pinduoduo, ByteDance and WeChat are rapidly growing their sales through this channel.

“Consumers learn how to cook, for example, a piece of steak online, and can then order the products on the streaming platform at a cheaper price than offered by supermarkets. Some food companies were reluctant to sell through this channel two years ago, but now almost all companies have developed live streaming distribution.”

Implications for New Zealand

Commenting on the implications of the changes in China for New Zealand’s red meat sector, New Zealand-based RaboResearch senior animal proteins analyst Jen Corkran said, it was encouraging to see Chinese beef consumption continuing to grow in a broad sense.

“China is New Zealand’s second largest market for beef exports accounting for about a third of total exports over the 2023/24 season (October to September). So it’s really positive to see beef consumption continuing to rise despite the recent challenges facing the Chinese economy,” she said.

“From 2013 to 2023, Chinese beef consumption grew by a compound annual growth rate (CAGR) of 3.2%, and there is scope for this to growth to continue as long as companies within the beef supply chain can successfully adapt to the changes in consumer trends within the Chinese market.”

In order to adapt to these changes, the report says, animal protein companies in New Zealand and other regions around the globe must pivot from a volume-centric to a consumer-centric approach.

“This involves focusing on value growth, with an emphasis on poultry, beef and high-value seafood,” the report says.

“Animal protein companies should also look at ‘downstream extension’ and closer integration with foodservice and retailers which will help them secure margin and meet consumer needs more effectively.”

Ms Corkran said the changes in China’s animal protein market present a unique set of challenges and opportunities and companies that adapt to these new consumption trends with agility and consumer focus are set to thrive in this dynamic environment.

“Given the vast majority of red meat produced in New Zealand is exported, it’s essential we have a deep understanding of our consumers across all of our key markets. And with China such a key destination for New Zealand beef and sheepmeat, it’s pivotal we stay closely connected to developments in this market to give ourselves the best chance of growing our market share into the future,” she said.