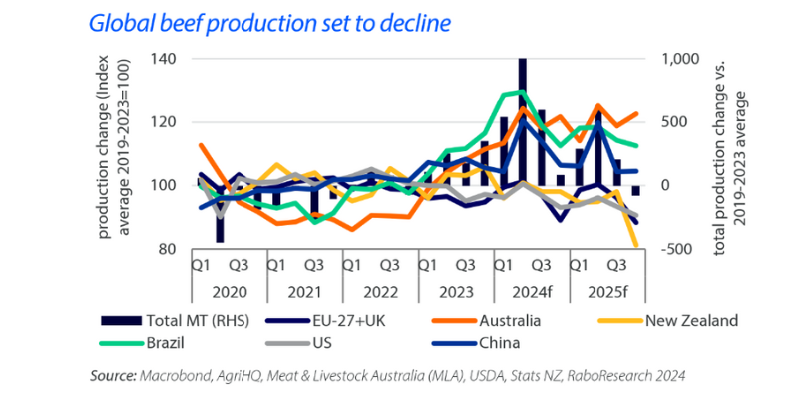

Herd contraction in the world’s four largest beef-producing nations – the US, Brazil, China and Europe – is expected to lead to the first global beef supply reduction since the Covid-19 pandemic, altering global beef trade flows in the year ahead, according to a new RaboResearch report.

In its latest Global Beef Quarterly report titled Navigating declining global production, uncertainty in 2025, Rabobank says Brazil and the US are likely to lead beef production declines next year.

“Reductions in China, Europe, and New Zealand are also likely, and Australia may be the only top-10 beef-producing country to post year-over-year production gains in 2025,” it says.

While North American cattle prices have been high for close to two years as a result of the lower cattle numbers and strong consumer demand, the report says, some other countries have experienced low cattle prices.

Jen Corkran, Senior Animal Protein Analyst, Rabobank New Zealand

“This trend has started to change as global beef supply declines start to firm up support for cattle prices in South America, Australia and New Zealand,” it said.

With available supplies altered across the top global beef markets, the report says, beef trade is expected to shift dramatically.

“We anticipate Australian beef producers will increasingly depend on exports to absorb stronger domestic production, while Brazil will see global markets as a better demand opportunity compared to lacklustre domestic demand,” report lead author RaboResearch senior animal protein analyst Angus Gidley Baird said.

The report says global beef production has the potential to swing dramatically if weather patterns change.

“US producers are waiting on more dependable precipitation to rebuild the herd, and Brazilian production is being slowed by rain delaying the supply of cattle fattened on pasture,” it says.

“Australia has maintained relatively adequate precipitation for a few years, but the threat of dryness could lead to more production.”

Mr Gidley-Baird said the status quo is likely to be maintained, when it comes to weather for 2025.

“The latest El Niño Southern Oscillation models are predicting La Niña weather conditions to persist into quarter one 2025, before a transition to a more neutral pattern by midyear.” he said.

“This will support Australian beef production. Furthermore, year-over-year declines in US beef production will remain relatively small, as US cow herd rebuilding remains stalled by slower replacement heifer development.”

New Zealand update

The report says total export volumes for New Zealand beef were down 19% year-on-year for quarter three, 2024, while average export values were up by 9% year-on-year across the same period.

RaboResearch senior agricultural analyst Jen Corkran said the overall increase in export value had largely been driven by strong volumes and value for beef exported to the US.

“US beef export values were up by 19% year-on-year for quarter three, averaging $10.56/kg, which is right up there with some of the best export value we’ve seen for New Zealand beef to the US market,” she said.

“However, this was partially offset by lower export values to China, which decreased by 5% year-on-year for quarter three to $6.78kg.

“Farmgate pricing across all cohorts of beef cattle was 15% to19% above five-year averages over quarter three, 2024, and this has helped cement beef as the golden goose of red meat exports for New Zealand.”

Looking at the full 2023/24 export season (1 October, 2023 – 30 September, 2024), Ms Corkran said US exports have dominated.

“Total US export volumes were up by 9% year-on-year to 181,000 metric tonnes (mt), while China volumes dropped by 22% year-on-year to 159,000mt,” she said.

“We’ve also seen some strong volume increases in secondary markets, with Japan and Canada increasing volumes by 46% and 50% year-on-year to 35,000mt and 24,400mt, respectively.”

Ms Corkran said on-farm weather conditions have been variable and were cooler than average over late winter and early spring.

“Broadly, across the North Island, pasture growth and utilisation has been strong, with more challenging very wet and cool conditions in the lower South Island.” she said.

“Looking forward, December is traditionally a strong production month and with some drier conditions presently in eastern regions of both islands, it is likely that more animals will be sent for processing pre-Christmas, before summer feed supply slows down and the January-March heat arrives.

“The optimistic outlook for beef in New Zealand could encourage producers to build cattle numbers leading to a production increase in coming years. 2024 has seen a 3.7% drop in bobby calf numbers, indicating more dairy beef may be being reared to enter the beef herd.”

RaboResearch Disclaimer: Please also refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release.