Results at a glance

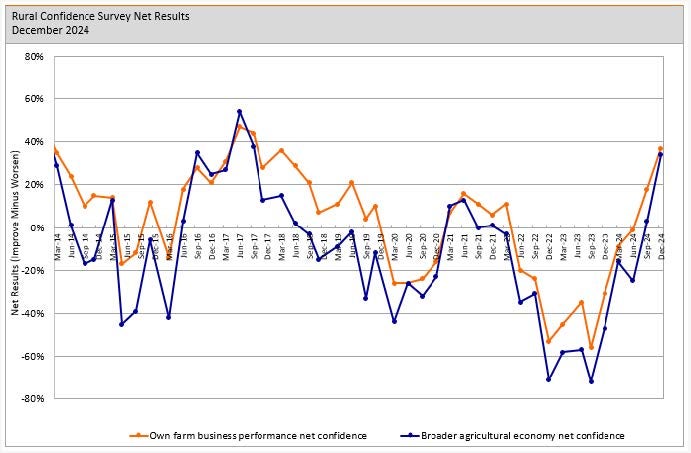

- Farmer confidence in the broader agri economy has risen strongly for the second consecutive quarter and is now at its highest level in over seven years.

- Among farmers with a positive outlook on the agri economy, higher commodity prices (59%), and falling interest rates (22%) were the major sources of optimism. Rising input costs (41%) remained the major concern identified by those looking less favourably at the year ahead.

- Farmer expectations for their own farm business performance also rose strongly off the back of improvement expectations among pastoral farmers. Horticulturalists remain in net positive territory on this measure but were less positive than in the previous quarter.

Bruce Weir, General Manager Country Banking, Rabobank New Zealand

- Farmer investment intentions increased with dairy farmers continuing to hold the strongest investment intent.

- The number of farmers self-assessing their own farm business as ‘unviable’ halved from last quarter (4% from 8% previously) while there was also a lift in the number of farmers assessing their own operation as ‘easily viable’.

- Famer expectations for rural land prices increased and more farmers are now expecting rural land prices to lift in the year ahead, than those expecting prices to fall.

Improved pricing for New Zealand’s dairy and red meat products has driven a strong lift in farmer sentiment, the fourth and final Rabobank Rural Confidence Survey of the year has found.

Following a sizeable lift in the September quarter, farmer confidence in the broader agri economy has risen again and the net confidence reading now sits at +34% (from +3%) – its highest level since mid-2017.

The latest survey — completed late last month — found 47% of farmers (30% previously) were now expecting the performance of the broader agri economy to improve in the year ahead, while the number expecting conditions to worsen had halved to 13% (from 27%). The remaining 38% of farmers expected conditions to stay the same (41% previously).

Rabobank General Manager for Country Banking Bruce Weir said it was fantastic to see confidence flowing back into the sector after a difficult last 18 months for industry participants.

“Having battled through a really tough period, farmers are now seeing some light at the end of the tunnel and their mood has noticeably lifted from earlier in the year,” he said.

“This is great to see as we move into the holiday season and bodes well for a strong year for the sector in 2025.”

The survey found pastoral farmers were the chief contributors to the overall lift in confidence, with their improved sentiment largely attributable to improved commodity pricing.

“Among farmers with an optimistic outlook, 59% cited improved commodity pricing as a key reason for holding this view, with this reflecting the hugely positive pricing movements we’ve seen across the last few months,” Mr Weir said.

“Since September, we’ve seen Fonterra make several upwards movements to the mid-point of their farmgate milk price forecast. We’ve also seen beef prices continue to strengthen and lamb prices start to pick up after a very challenging period.”

Mr Weir said the latest survey period concluded on November 27, and since then there had been several further pieces of good news for primary producers.

“In late November, the Reserve Bank dropped the OCR by a further 50 basis points which will help reduce farmers’ interest costs, while on Thursday last week, Fonterra announced a further upwards revision to their milk price forecast, bumping this up to a record-breaking $10kg/MS,” he said.

“This is all really positive news for the sector and, if the survey was taken today, there’s a really strong case to say that farmer confidence would be even higher than it was just a couple of weeks ago.”

Among the 13% of farmers with a pessimistic outlook on the broader agri economy, the survey found rising input costs (41%), government intervention/policies (35%) and overseas markets (30%) were the major factors cited for holding this view.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations had also improved, with the net reading on this measure lifting to +37% from +19% previously. As with headline confidence, this is the strongest reading on this measure since mid-2017.

Not surprisingly, dairy farmers continue to be the most optimistic of all the sector groupings, with close to seven in 10 now expecting an improved performance from their own operation across the next 12 months. Sheep and beef farmers were also markedly more upbeat about the prospects for their own businesses, with three in 10 expecting improved performance and only one in 10 now expecting performance to worsen.

Mr Weir said horticulturalists bucked the upwards trend, recording a lower reading on this measure.

“Growers are still broadly positive about the year ahead for their own operations – with more expecting their own farm business performance to improve than those expecting it to worsen – but they are less optimistic than in September and are now the most pessimistic of all the sector groupings,” he said.

“Horticulturalists haven’t seen the same recent price revival as their counterparts in the pastoral sectors, and lingering concerns over farm input prices and the outlook for overseas markets appear to be holding sentiment back.”

Viability and investment intentions

The survey found farmers’ investment intentions increased with the net reading on this measure lifting to +18% from +2% previously.

Dairy farmers recorded the strongest investment intentions, increasing to a net reading of +39% (from +21% previously) while investment intentions among sheep and beef farmers also rose (net reading of +2% from -17% last quarter). Horticulturalists’ investment intentions were marginally weaker falling to a net reading of -5% (-3% previously).

“This survey also saw some positive movements with regard to farm viability with more farmers now assessing their own operations as ‘easily viable’ (up to 22% from 17% previously) and a halving of those who assessed their own operation as ‘unviable (4% from 8% last quarter),” Mr Weir said.

“This is the smallest percentage we’ve seen in the ‘unviable’ bucket since late 2022 and we’re hopeful this will drop even further in 2025.”

Rural land values

Mr Weir said improved farmer sentiment was also helping to revive previously subdued farmer expectations for rural land values.

“We’ve been collecting data on expectations for rural land values every second quarter since late 2022, and this the first time we’ve had more farmers expecting rural land values to increase over the next 12 months than those tipping land values to fall,” Mr Weir said.

“This quarter, 30% of farmers were expecting to see farm prices lift, with only 12% expecting a fall. And this aligns with the feedback we’re getting from our agri managers around the traps who are now starting to see some farm sales at improved prices — particularly for dairy farms.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.