Results at a glance

- Farmer confidence in the broader agri economy has risen strongly and is now at net positive levels for the first time since quarter four of 2021.

- Among farmers with a positive outlook on the agri economy, higher commodity prices (40 per cent), and falling interest rates (31 per cent) were the major sources of optimism. Rising input costs (48 per cent) remained the major concern identified by those looking less favourably at the year ahead.

- Farmers across all sectors were also now more positive about the prospects for their own businesses, with each of the three major sector groupings (dairy farmers, sheep and beef farmers and horticulturalists) recording net positive readings on this measure.

Todd Charteris, CEO, Rabobank New Zealand

- The number of farmers self-assessing their own farm business as ‘unviable’ was similar to last quarter (eight per cent from seven per cent previously) however more farmers now assess their operations as ‘viable’ or ‘easily viable’.

- The net reading for farmer investment intentions rose marginally and is now at net positive levels overall.

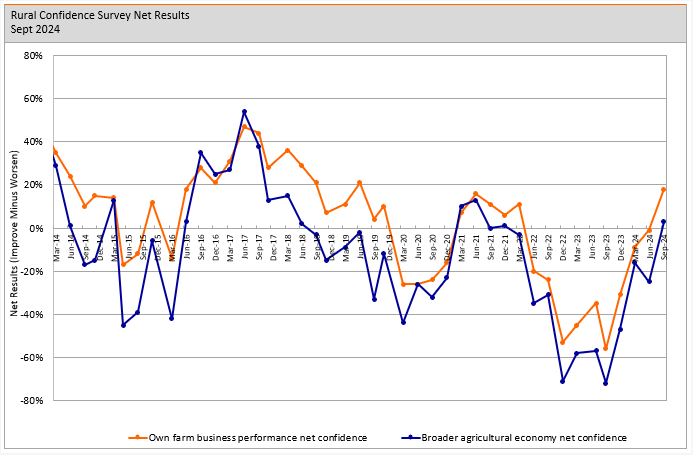

Farmer confidence in the broader agri economy has risen strongly and is back at net positive levels for the first time since late 2021, the latest Rabobank Rural Confidence Survey has found.

Following a small dip in the June quarter, the latest survey found farmer confidence in the broader agri economy had increased to a net reading of + three per cent from -25 per cent previously.

The latest survey — completed earlier this month — found the number of farmers expecting the performance of the broader agri economy to improve in the year ahead had doubled since last quarter to 30 per cent (15 per cent previously), while the number expecting conditions to worsen had fallen to 27 per cent (from 40 per cent). The remaining 41 per cent of farmers expected conditions to stay the same (44 per cent previously).

Rabobank CEO Todd Charteris said the arrival of spring had brought with it a lift in primary producer sentiment, with farmers across all sector groupings now more upbeat about the year ahead.

“Across the previous 10 surveys, pessimism has been the dominant sentiment, so it is really encouraging to see net confidence on the up and back in net positive territory – even if only just, with more farmers positive than negative about the 12 months ahead,” he said.

“The country’s farmers and growers are doing a great job and are rightly recognised as some of the world’s most efficient food producers. The agri sector makes such a vital contribution to New Zealand’s overall economy, so it’s great to see such a healthy lift in sentiment since our last survey.”

Mr Charteris said farmers anticipating a better year ahead cited higher commodity pricing (40 per cent) and falling interest rates (31 per cent) as the two major reasons for expecting conditions to improve.

“Since the last survey in June, we’ve seen global dairy prices continue to trend upwards with this culminating in Fonterra lifting their milk price forecast by 50 cents to a mid-point of $8.50kg/MS in late August,” he said.

“We’ve also seen prices for beef continue to soar, while sheepmeat prices have inched upwards as the new season approaches.

“In addition, farmers have been buoyed by the RBNZ’s decision to lower the Official Cash Rate by 25 basis points in August. And with further rate cuts expected over the months ahead, we’ve seen bank interest rates fall significantly across recent months.”

Among farmers holding a pessimistic view of the 12 months ahead, the survey found, rising input prices (48 per cent) continue to be the major source of concern.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were up across the board.

“As with the broader agri economy, farmers are now much more upbeat about the prospects for their own businesses, with the net reading on this measure lifting to +18 per cent from - one per cent previously,” Mr Charteris said.

“Each of the major sector groupings – dairy, sheep and beef, and horticulture – recorded net positive readings, and we have to go all the way back to quarter three in 2021 for the last time this happened.”

The survey found dairy farmers and sheep and beef farmers were now much more optimistic about their own businesses than they were in June.

“Dairy farmers are now the most optimistic of all the sector groupings with 42 per cent now expecting the performance of their own business to improve in the next 12 months and less than one in 10 expecting it to worsen,” he said.

“We also saw a strong lift from sheep and beef farmers on this measure, up to a net reading of + six per cent (from -17 per cent) while growers recorded a more modest lift (+29 per cent from +26 per cent last quarter.)

Viability and investment intentions

While the percentage of farmers self-assessing their own operations as ‘unviable’ was largely unchanged from last quarter (eight per cent from seven per cent previously), Mr Charteris said, there had been an upward movement at the other end of the scale.

“We’d hoped to see the percentage of farmers assessing themselves as ‘unviable’ drop a bit lower. And the fact we’re still seeing this number at a stubbornly high eight per cent does reflect the really challenging environment primary producers have faced over the last couple of years,” he said.

“That aside, it was good to see an uptick in the percentage of farmers viewing their own businesses as ‘viable’ or ‘easily viable’, with this rising to 55 per cent from 48 per cent previously.

“We also saw farm investment intentions creeping upwards with 19 per cent of farmers expecting investment to increase in the next 12 months (14 per cent last quarter), and only 17 per cent expected it to reduce (23 per cent previously).

“And, as with the headline confidence measure, it’s been over two years since we’ve seen investment intentions in net positive territory.”

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.