Skyrocketing cocoa prices are putting strong pressure on chocolate producers around the globe, who will likely pass on the burden to consumers, according to a new international report by food and agribusiness banking specialist, Rabobank.

In the report Soaring Cocoa prices: The worst is yet to come, the bank says the main impact of the cocoa crisis still lies ahead, as companies hedge prices and supply contracts up to a year in advance.

“Significantly-higher chocolate prices will likely hit shelves over the coming months and going into 2025, providing a major challenge for the chocolate sector, which is already battling a longer-term, structural decline in demand,” the report says. Cocoa crisis

A “cocoa crisis” is triggering the prices increases, the report, by the bank’s research arm, RaboResearch, says.

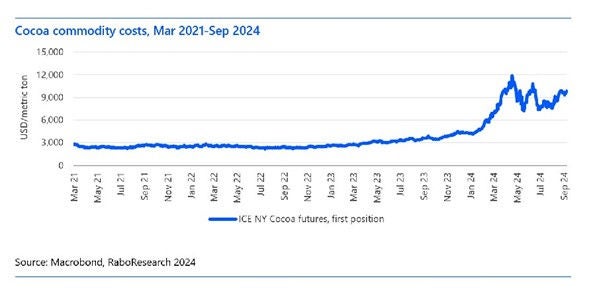

In an unprecedented surge, the report says, cocoa commodity prices have hit their highest levels in nearly 50 years.

“Since January 2023, cocoa futures have shattered the calm of their previous trading range, peaking at nearly USD 12,000 per metric ton in the first half of 2024,” RaboResearch analyst Paul Joules said.

Paul Joules, RaboResearch, Agricultural Analyst

“This dramatic increase, fuelled by a global cocoa shortage, is primarily due to a disappointing harvest in West Africa, the source of 70 per cent of the world's cocoa. “The International Cocoa Organization (ICCO) reports a 14.2 per cent drop in global cocoa production for the 2023/24 season, leading to a shortage of approximately 462,000 metric tons and the lowest cocoa stocks in 22 years.”

Rising Retail Prices

Retail prices are on the rise, and a much bigger impact is yet to come, the report says. “Chocolate manufacturers are struggling with soaring cocoa costs, which are reflected in higher local retail prices for chocolate,” Mr Joules said.

“This is illustrated by recent Stats NZ data[1] which found the price of a 250g block of chocolate has increased 20 percent since this time last year.

Mr Joules said despite recent increases, the full force of the cocoa crisis is likely yet to be felt on supermarket shelves globally.

“Due to the lag in the supply chain and existing contracts, the steepest price hikes are anticipated in the second half of 2024 and into 2025,” he said.

“This would inevitably lead to higher prices for consumers, particularly for dark chocolates with higher cocoa content.’ Shrinkflation/Skimpflation

To combat rising costs, Mr Joules said chocolate manufacturers across the globe are adopting various strategies.

“These include ‘shrinkflation’, which is reducing package sizes while maintaining prices, and ‘skimpflation’, which is altering recipes to use less cocoa and more fillers,” he said.

“These tactics, while effective, are often unpopular with consumers.”

Consumer Demand

The report says as retail prices rise, consumers are likely to alter their buying habits, switching between chocolate types and brands, and potentially moving toward private labels or alternative treats.

“The increased cost of chocolate is expected to lead to a significant drop in consumer demand. This market correction should balance the cocoa supply shortage and stabilise prices,” Mr Joules said.

“For the western European market, a decline in chocolate volumes in the mid-to-high-single digits is projected, with this becoming more apparent in 2025.

“The global chocolate sector is already facing a structural shift away from sweets, with volume sales declining in recent years. The current crisis adds to the challenges, making a return to significant growth unlikely in the near future.”

[1] Food prices increase 0.4 percent annually | Stats NZ

RaboResearch Disclaimer: Please refer to our disclaimer here for information about the scope and limitations of the RaboResearch material provided in this media release