Results at a glance

- Farmer confidence in the broader agri economy has risen for the third consecutive quarter off the back of improved sentiment among sheep and beef farmers.

- Among farmers with a positive outlook on the agri economy, higher commodity prices (62%), and falling interest rates (22%) were the major sources of optimism. Government intervention/ policies (37%) and rising input costs (33%) were the major concerns identified by those looking less favourably at the year ahead.

- Farmer expectations for their own farm business performance over the next 12 months were back marginally from last quarter but remain strong overall. Sheep and beef farmers were markedly more positive about the prospects of their own businesses than last quarter while dairy farmers and growers were less positive.

Bruce Weir, General Manager of Country Banking, Rabobank New Zealand

- Farmer investment intentions were relatively unchanged from last quarter with more farmers expecting to increase investment in the year ahead than those expecting investment to reduce.

- The number of farmers self-assessing their own farm business as ‘unviable’ rose to 5% (from 4% previously) while there was also a lift in the number of farmers assessing their own operation as ‘easily viable’ (29% from 22% last quarter).

Improved sentiment among sheep and beef farmers has helped drive a third consecutive lift in New Zealand farmer confidence, the first Rabobank Rural Confidence Survey of the year has found.

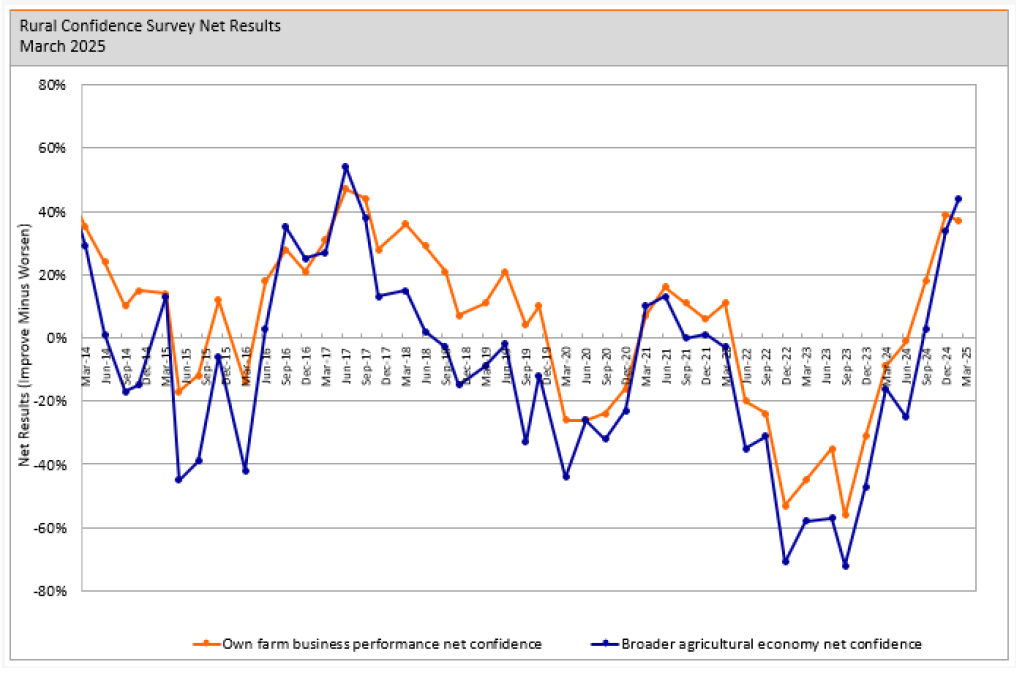

Following a big jump in the last quarter of 2024, farmer confidence in the broader agri economy has risen again and the net confidence reading now sits at +44% (from +34%). This is the second-highest net reading recorded across the past decade, with only the quarter two reading in 2017 (+52%) higher.

The latest survey — completed early this month — found 52% of farmers were now expecting the performance of the broader agri economy to improve in the year ahead (up from 47% in the previous quarter), while the number expecting conditions to worsen had fallen to 8% (from 13%). The remaining 36% of farmers expected conditions to stay the same (38% previously).

Rabobank General Manager for Country Banking Bruce Weir said the uplift in confidence in the broader agri economy had been driven by improved sentiment among the country’s sheep and beef farmers.

“In our last survey late last year, we saw a big jump in dairy farmers’ confidence in the agri economy off the back of improved expectations for the 24/25 milk price forecast and, this time around, it’s their counterparts in the sheep and beef sector who have recorded a big uplift,” he said.

“Beef prices have been healthy for an extended period and, with sheepmeat prices having recovered strongly over recent months, farmers across this sector are now looking towards the year ahead with much more optimism.

“Dairy farmers and horticulturalists are still upbeat about the prospects for the broader ag economy, but it’s now sheep and beef farmers who are the most confident, with about 6 in 10 expecting the broader agri economy’s performance to improve and less than 1 in 10 expecting it to worsen.”

As with the final survey of 2024, the most recent survey found higher commodity prices (62%) and lower interest costs (22%) were the major drivers of positive sentiment among farmers.

“Strong pricing for the majority of New Zealand’s major agri exports has boosted farmer incomes while, on the cost side, we saw another 50-basis point drop in the Official Cash Rate in early February which has helped push farmer interest costs lower,” Mr Weir said.

“And this one-two combo of rising commodity prices and falling interest rates is for doing wonders for farmer margins.”

Among the 8% of farmers expecting conditions in the agri economy to deteriorate, government intervention/ policies (37%), farm input prices (33%) and overseas market (22%) were the major factors cited.

Own farm business performance

The survey found farmers’ expectations for their own farm business operations were largely unchanged from last quarter, with the net reading slightly lower at +37% (from +39% last quarter).

Mr Weir said while there had been little movement in the overall reading, there had been significant movement at a sector level.

“As with their confidence in the broader agri economy, sheep and beef farmers were much more optimistic about their own businesses, jumping to a net reading of +41% from +20% previously,” he said.

“Somewhat surprisingly, dairy farmers moved in the opposite direction with their net reading on this measure down to +48% from +66% previously. And while this is still an historically high reading, it appears ongoing concerns about government policy and farm input prices, uncertainty in the global macroeconomic environment – including the potential impact of US tariffs – and dry weather conditions here in New Zealand have combined to temper confidence among dairy sector participants.”

The survey found growers were also less positive about the prospects for their own operations in the year ahead with the net reading on this measure dropping into negative territory for the first time since mid-2023.

“Growers hold similar concerns to their counterparts in the dairy sector,” he said.

“While, on top of these, general oversupply in the global wine sector is also likely to be a driver of lower overall sentiment amongst horticulturalists as this has contributed to lower New Zealand wine export revenue over the last 12 months and to wineries holding high levels of stock.”

Viability and investment intentions

The survey found farmers’ investment intentions were largely unchanged from last quarter with 29% of farmers expecting to increase investment over the coming year (from 28%), 13% expecting it to reduce (10% previously) and the remaining 57% expecting it to remain the same (from 61%).

Dairy farmers continue to have the strongest investment appetite, but this was back on last quarter, falling to a net reading of +29% (from +39% previously). Sheep and beef farmers’ investment intentions were up to a net reading of +12% (+2% previously), while growers’ investment intentions also rose, increasing to +2% from -5% previously.

Mr Weir said the survey also found some minor changes in farmers’ perceptions of their operations’ viability.

“The number of farmers assessing their own operation as ‘unviable’ was up to 5% from 4% last quarter, however we also saw a change at the other end with 29% of farmers now viewing their operations as ‘easily viable’ from 22% late last year,” he said.

Conducted since 2003, the Rabobank Rural Confidence Survey is administered by independent research agency KANTAR, interviewing a panel of approximately 450 farmers each quarter.